Australia to Grant Up to A$810 Super Bonus to One Million Low-Income Workers Amid Broader Tax Reforms

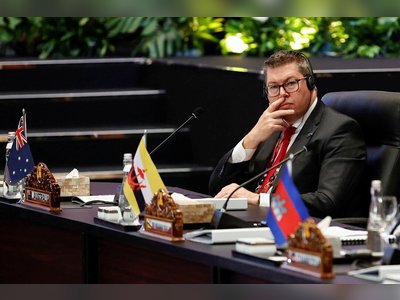

Treasurer Jim Chalmers unveils changes to superannuation tax offsets and higher levies on very large funds

More than 1.3 million Australians working in retail, care, and other lower-income sectors are poised to receive an automatic superannuation bonus of up to A$810, under a newly revised reform package announced by Treasurer Jim Chalmers.

The plan raises the income eligibility for the Low Income Superannuation Tax Offset (LISTO) from A$37,000 to A$45,000, widening the benefit and boosting payments for many currently excluded.

In response to political and industry pressure, the government has retreated from taxing unrealised capital gains, instead introducing a tiered tax structure for large super balances.

Earnings on balances between A$3 million and A$10 million will now face a 30 percent rate, while amounts above A$10 million will carry a 40 percent levy.

These thresholds will be indexed to inflation, and implementation is deferred to 1 July 2026.

The revised policy abandons the original design’s more aggressive scope, resulting in a projected revenue shortfall of roughly A$4.2 billion over four years.

Mr Chalmers defended the adjustments as a necessary recalibration, asserting they preserve the reform’s intent while making the system fairer and more politically viable.

Treasurer Chalmers framed the changes as delivering a “fairer super system from top to bottom,” saying they help “lower-income workers earn more, keep more of what they earn and retire with more too”.

He singled out clerks, carers, and cashiers as among the sectors to benefit most from expanded access to super contributions.

Opposition and Greens voices have pushed back, warning that the watering down of earlier proposals may weaken long-term equity.

Chalmers argues that the new package balances ambition with realism and is committed to securing Senate support—particularly from Greens senators—to pass the legislation.

Beyond the LISTO adjustments and high-balance levies, the government also introduced “payday super” reforms intended to force employers to deposit super contributions within seven business days of payday, starting 1 July 2026.

This change is designed to reduce the A$5.2 billion gap in unpaid super contributions and help younger and casual workers build retirement equity.

If adopted, the reforms will mark a significant reshaping of Australia’s superannuation tax regime: rewarding lower-income earners, imposing higher taxes on extreme balances, and anchoring reforms in more politically sustainable terrain.

The plan raises the income eligibility for the Low Income Superannuation Tax Offset (LISTO) from A$37,000 to A$45,000, widening the benefit and boosting payments for many currently excluded.

In response to political and industry pressure, the government has retreated from taxing unrealised capital gains, instead introducing a tiered tax structure for large super balances.

Earnings on balances between A$3 million and A$10 million will now face a 30 percent rate, while amounts above A$10 million will carry a 40 percent levy.

These thresholds will be indexed to inflation, and implementation is deferred to 1 July 2026.

The revised policy abandons the original design’s more aggressive scope, resulting in a projected revenue shortfall of roughly A$4.2 billion over four years.

Mr Chalmers defended the adjustments as a necessary recalibration, asserting they preserve the reform’s intent while making the system fairer and more politically viable.

Treasurer Chalmers framed the changes as delivering a “fairer super system from top to bottom,” saying they help “lower-income workers earn more, keep more of what they earn and retire with more too”.

He singled out clerks, carers, and cashiers as among the sectors to benefit most from expanded access to super contributions.

Opposition and Greens voices have pushed back, warning that the watering down of earlier proposals may weaken long-term equity.

Chalmers argues that the new package balances ambition with realism and is committed to securing Senate support—particularly from Greens senators—to pass the legislation.

Beyond the LISTO adjustments and high-balance levies, the government also introduced “payday super” reforms intended to force employers to deposit super contributions within seven business days of payday, starting 1 July 2026.

This change is designed to reduce the A$5.2 billion gap in unpaid super contributions and help younger and casual workers build retirement equity.

If adopted, the reforms will mark a significant reshaping of Australia’s superannuation tax regime: rewarding lower-income earners, imposing higher taxes on extreme balances, and anchoring reforms in more politically sustainable terrain.

AI Disclaimer: An advanced artificial intelligence (AI) system generated the content of this page on its own. This innovative technology conducts extensive research from a variety of reliable sources, performs rigorous fact-checking and verification, cleans up and balances biased or manipulated content, and presents a minimal factual summary that is just enough yet essential for you to function as an informed and educated citizen. Please keep in mind, however, that this system is an evolving technology, and as a result, the article may contain accidental inaccuracies or errors. We urge you to help us improve our site by reporting any inaccuracies you find using the "Contact Us" link at the bottom of this page. Your helpful feedback helps us improve our system and deliver more precise content. When you find an article of interest here, please look for the full and extensive coverage of this topic in traditional news sources, as they are written by professional journalists that we try to support, not replace. We appreciate your understanding and assistance.