EQT Holdings and Two Rising Australian Small Caps Attract Investor Attention

Australian investors seeking opportunities beyond large cap stocks have recently focused on a set of lesser-known companies exhibiting promising financial metrics and growth potential.

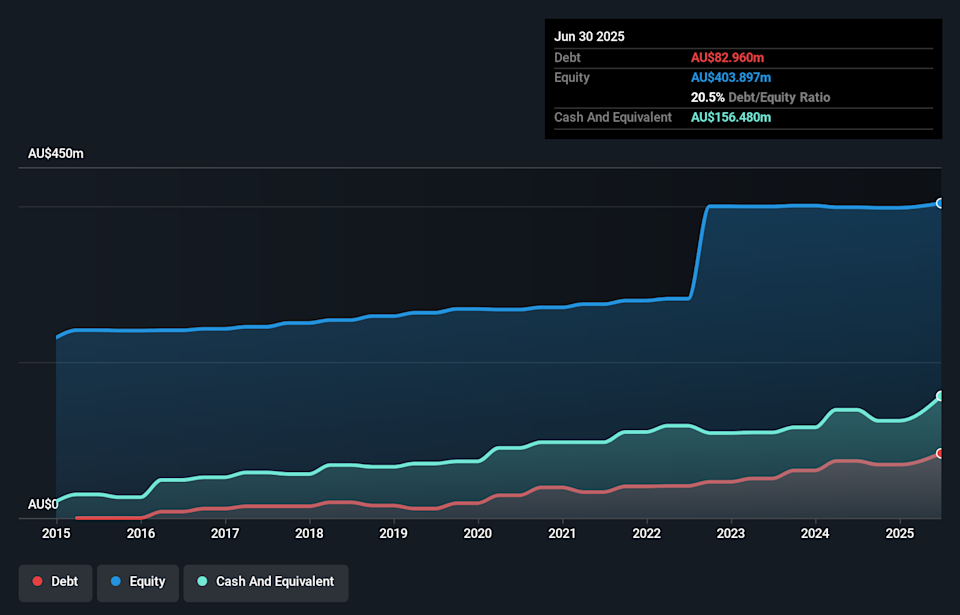

EQT Holdings Limited, a trustee and financial services provider listed on the Australian Securities Exchange, has drawn attention for its robust earnings growth and strong balance sheet.

The company operates in philanthropic, trustee and wealth management services and has reported notable year-on-year earnings expansion while maintaining interest coverage well above obligations. Its financial position, including a healthy cash buffer relative to debt, supports its resilience and strategic initiatives in digital transformation and client service enhancement.

Cobram Estate Olives Limited is another small cap gaining interest for its performance in the agribusiness sector. The olive oil producer has demonstrated meaningful earnings increases and improved financial management over recent periods. Cobram’s expansion in domestic and international markets, coupled with operational efficiencies that have helped reduce leverage, underscores its potential to benefit from ongoing demand for premium food products.

Meanwhile MFF Capital Investments Limited, an investment firm with a focus on equity portfolios, presents a contrasting but complementary opportunity. With a strong capital base and a debt-free structure, MFF has generated positive free cash flow and trades at valuations below estimated fair value, suggesting appealing entry points for long-term investors.

The company’s financial discipline and diversified investment approach provide stability amid broader market volatility. In a landscape where broader indices have shown mixed performance, these three companies—EQT Holdings, Cobram Estate Olives and MFF Capital Investments—offer differentiated profiles that have captured investor interest for their fundamentals, strategic positioning and potential upside in future market cycles.