Australian Federal Budget 2025: Key Highlights and Economic Outlook

The 2025 federal budget features surprise tax cuts, significant wage increases for select workers, and a $27.6 billion deficit amid efforts to provide cost-of-living relief.

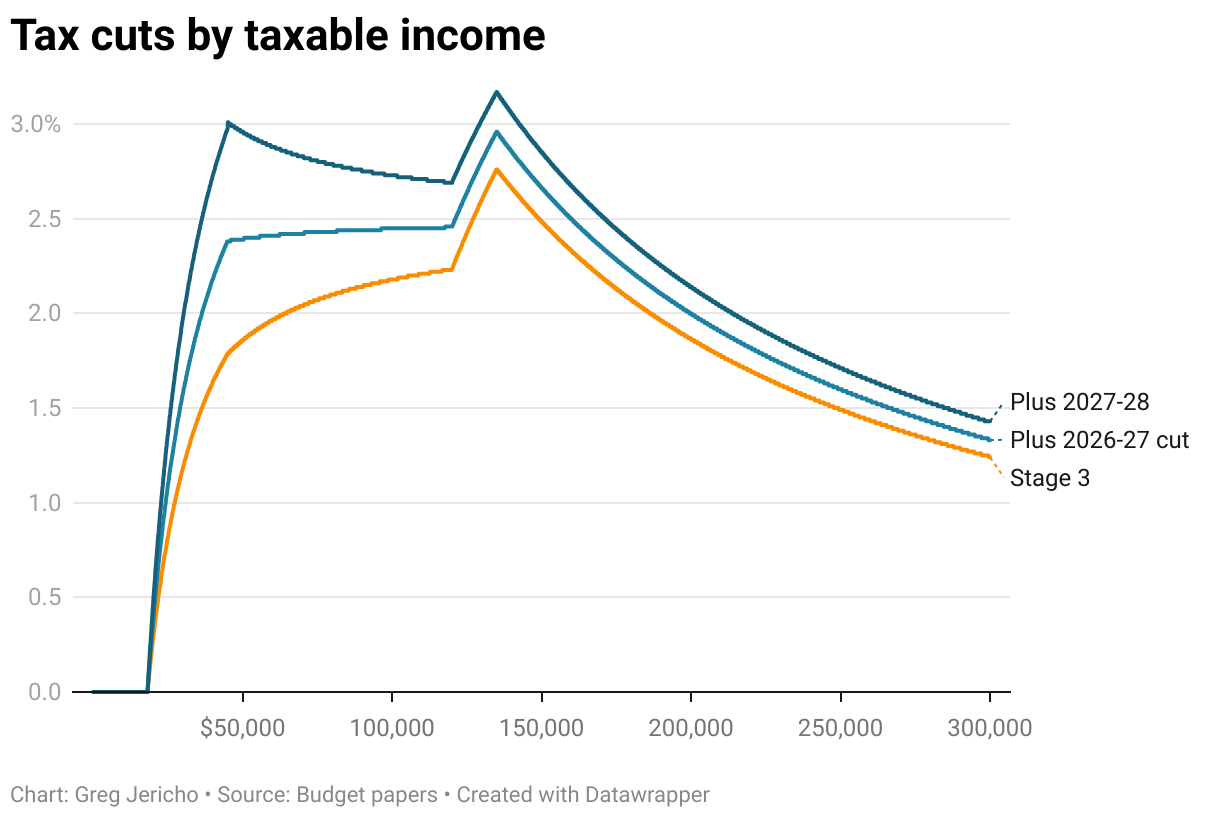

The Australian government has announced a series of fiscal measures in the 2025 federal budget, which includes a $17 billion tax cut for all taxpayers, effective from 2026-27. This cut reduces the tax rate for individuals earning between $18,201 and $45,000 from 16 to 15 percent, followed by a further reduction to 14 percent in 2027-28. The average taxpayer within this bracket will receive a reduction of $268 in their tax bill for the 2026-27 financial year, increasing to $536 the following year.

The budget, delivered by Treasurer Jim Chalmers, reveals a national deficit of $27.6 billion, surpassing previous forecasts by $700 million.

This marks a return to deficit for the first time since 2022, with projected deficits expected to continue through to 2028-29, including forecasts of $42.1 billion for 2025-26 and $35.7 billion for 2026-27.

In conjunction with tax cuts, the government plans to increase thresholds for the Medicare levy, providing an additional $648 million in tax relief while aiming to alleviate ongoing cost-of-living pressures faced by Australians.

Forecasts within the budget suggest real wage growth of 0.5 percent by the end of the current financial year, with GDP growth anticipated at 2.25 percent for 2025-26. The government projects inflation to remain within the Reserve Bank's target range of 2.5 to 3 percent for the next three years, with wage increases expected to reach up to 3.25 percent, alongside an unemployment rate projected to maintain at 4.25 percent.

The 2025 federal budget also highlights increased wages for aged care and childcare workers, with an allocated investment of $2.6 billion to boost pay for aged care nurses, alongside an additional $3.6 billion for a 10 percent increase in childcare award rates.

Further efforts to alleviate living costs include $150 energy bill rebates for households and a significant reduction in the costs of certain medicines under the Pharmaceutical Benefits Scheme.

Legislation proposed in the budget aims to ban non-compete clauses for low- and middle-income workers, potentially allowing for wages to increase by up to 4 percent and enhancing productivity.

The budget acknowledges growing international economic uncertainties, particularly due to geopolitical tensions and trade issues, including potential impacts from tariffs imposed by the United States, which are expected to minimally affect Australian GDP growth.

Additional provisions include subsidized childcare for families with a combined income under $530,000, and a one-off 20 percent discount on outstanding student debt, intended to benefit approximately three million Australians.

These comprehensive fiscal measures reflect the government's commitment to addressing immediate economic challenges while managing a complex international economic landscape.

The budget, delivered by Treasurer Jim Chalmers, reveals a national deficit of $27.6 billion, surpassing previous forecasts by $700 million.

This marks a return to deficit for the first time since 2022, with projected deficits expected to continue through to 2028-29, including forecasts of $42.1 billion for 2025-26 and $35.7 billion for 2026-27.

In conjunction with tax cuts, the government plans to increase thresholds for the Medicare levy, providing an additional $648 million in tax relief while aiming to alleviate ongoing cost-of-living pressures faced by Australians.

Forecasts within the budget suggest real wage growth of 0.5 percent by the end of the current financial year, with GDP growth anticipated at 2.25 percent for 2025-26. The government projects inflation to remain within the Reserve Bank's target range of 2.5 to 3 percent for the next three years, with wage increases expected to reach up to 3.25 percent, alongside an unemployment rate projected to maintain at 4.25 percent.

The 2025 federal budget also highlights increased wages for aged care and childcare workers, with an allocated investment of $2.6 billion to boost pay for aged care nurses, alongside an additional $3.6 billion for a 10 percent increase in childcare award rates.

Further efforts to alleviate living costs include $150 energy bill rebates for households and a significant reduction in the costs of certain medicines under the Pharmaceutical Benefits Scheme.

Legislation proposed in the budget aims to ban non-compete clauses for low- and middle-income workers, potentially allowing for wages to increase by up to 4 percent and enhancing productivity.

The budget acknowledges growing international economic uncertainties, particularly due to geopolitical tensions and trade issues, including potential impacts from tariffs imposed by the United States, which are expected to minimally affect Australian GDP growth.

Additional provisions include subsidized childcare for families with a combined income under $530,000, and a one-off 20 percent discount on outstanding student debt, intended to benefit approximately three million Australians.

These comprehensive fiscal measures reflect the government's commitment to addressing immediate economic challenges while managing a complex international economic landscape.

AI Disclaimer: An advanced artificial intelligence (AI) system generated the content of this page on its own. This innovative technology conducts extensive research from a variety of reliable sources, performs rigorous fact-checking and verification, cleans up and balances biased or manipulated content, and presents a minimal factual summary that is just enough yet essential for you to function as an informed and educated citizen. Please keep in mind, however, that this system is an evolving technology, and as a result, the article may contain accidental inaccuracies or errors. We urge you to help us improve our site by reporting any inaccuracies you find using the "Contact Us" link at the bottom of this page. Your helpful feedback helps us improve our system and deliver more precise content. When you find an article of interest here, please look for the full and extensive coverage of this topic in traditional news sources, as they are written by professional journalists that we try to support, not replace. We appreciate your understanding and assistance.